Saturday, June 8, 2024

Our Nation Is Dying Because Of Idle Shepherds Who Refuse To Get Involved In ‘Political Issues’

Abortion is one of the driving political forces of this current election cycle. Sadly, many ill-informed pastors and Christians refuse to get involved in things like the sanctity of life because of their politics. “That’s political stuff,” they say. Really?

Do you know how that happened? Politicians ran into the church, took the topic of abortion, and declared it to be a political issue, knowing that a weak, worthless, wimpy church would bow down and leave the scene. The political world ran in and said, “Marriage is not a church issue; it’s a political issue!” And the church just collapsed and folded.

As you can tell, I have no confidence at all in a church that is not a New Testament church. Why would I? Why would anybody? The church has to be the ground and pillar of all truth. The church has to be the entity by which the world is brought to the knowledge of God and also the conviction of God. The church is to be the most loved and the most hated people on Earth—just like Jesus.

If you are a pastor who says, “We just preach the gospel,” and neglects to get involved in the things your people have to live through six days a week, you are an idle Shepherd. You may have a degree. You may have your doctorate in ministry. You may come from a long line of preachers.

That is irrelevant! Unless you and I are being salt and light and effective in the culture, we have become good for nothing to be cast out on the roadway and trampled under the foot of men (Matt. 5:13). In that scenario, our lampstand has been removed from its holder, Jesus said, because it has become a candle without a light (Matt. 5:14-16).

Christian: This nation is dying, if it’s not already dead. Why? A dead church.

This nation is reflecting the condition of the church today, and it’s in shambles because of sleeping pulpits and people who are too cowardly to get involved and to talk to the school board, the city council, the governor, and the President. This cannot happen. This violates the heart of God.

Each of us is going to have to make a decision. Do you do what God tells you to do, or will you do what Caesar tells you to do? Whoever you obey, that is your Lord. If Caesar says you are forbidden to talk about these issues—that they have taken and declared to be political—are you going to cower back into your corner and stay silent? If so, then you are complicit in the destruction and the attack against the will of God.

I pray that you will find it within yourself as a believer to get involved, knowing that at any moment, we can go to heaven by either rapture or death. Until that time, “Let your light so shine before men, that they may see your good works, and glorify your Father which is in heaven” (Matt. 5:16). CONTINUE

Pushing Back On Pride: Has The Damage Already Been Done To An Entire Generation?

The month of June can be a disappointing, discouraging, and at times, a sickening month for Christians and conservatives due to the non-stop, relentless promotion of pride, perversion, and public displays of hyper-sexualized behavior.

Let’s be honest. It’s not just a one-month campaign; it’s year-round, so let’s drop the formalities, and the talking points that the LGBTQ community needs more exposure and visibility.

Children are watching. Many of them have grown up thinking it’s all normal, natural, and even healthy because that’s what they’ve been told. Too many have been recruited, some have become activists while others have experienced depression driving them to attempt suicide.

Words have been redefined and used as weapons. Where’s the church? Where’s the resistance to this deadly, sinful ideology? Pride is an offense to God, and yet, some professing Christians support this.

The Bible states that “Pride goes before destruction, And a haughty spirit before stumbling” (Proverbs 16:18).

Ephesians 5:11 warns believers, “do not participate” in deeds of darkness, but rather, expose evil. The past silence of believers in America has been misinterpreted as consent of homosexuality and beyond. I believe today we’re seeing the consequences of Christians taking the path of least resistance.

How did we get here? There is a chapter in my new book, Assault on the Image of God, that details the extensive progression of this movement going all the way back to the 1950s. It’s a “Transgender Event Historical Timeline.”

In more recent history, Target and Disney are just two of the big corporations to push pride programming. Disney doubled down after losing hundreds of millions of dollars last year, its worst year since 1974. It hosts Pride nights in its theme parks and continues pushing LGBTQ ideology in its movies and TV shows.

Target has had Pride displays in its stores since around 2012, but in the last two years or so, Target’s stock price has fallen by more than 40%. Disney has also taken a huge hit which indicates more Americans are tired of the onslaught. But don’t think these corporate giants are laying off the demonic agenda or reversing course anytime soon.

The good news is Target is cutting back on the assortment of LGBTQ-Pride products in its collection to ‘only’ 75 items. Seventy-five is still a lot if you ask me, but they used to have a mind-boggling 2,000 Pride products a year ago. Two thousand!

Boycotts matter – though they are reducing, not removing displays and online products. CONTINUE

South Korea Has Gold Bar Vending Machines...And They're Selling Out

BY TYLER DURDEN

First, it was Costco selling (and selling out of) gold bars, as we reported last year. Now, you can buy them in vending machines in South Korea.

One way or another, it looks as though the public wants gold.

Bloomberg reported this week that in Seoul's upscale Gangnam district, a GS Retail Co. convenience store features a vending machine selling gold bars, ranging from less than 1 gram to 37.5 grams, with prices starting at around 88,000 won ($64) and fluctuating daily. Initially launched in 2022, these machines are now in 30 stores nationwide

South Koreans are joining the global investing trend, with many investing in fractional shares and physical gold, amid widespread interest in various asset types, from meme stocks to cryptocurrencies, the report noted.

The one thing we see in common with the United States? People that want to exit from the fiat system.

A GS spokesperson told Bloomberg: “Currently we are seeing about 30 million won of sales per month. The gold vending machine draws customers’ attention due to increasing demand for safe haven assets and the spreading trend of micro-investing.”

Park Sang-hyun, an economist at HI Investment & Securities in Seoul, added that investors have a “fear of missing out when everything rallies, and that partially contributed to the scene.”

He added: “Feeling uncertainty about the global economy prompts safe haven demand.”

In South Korea, the convenience store CU, a competitor of GS, quickly sold out its ultralight gold cards, with the 1-gram options disappearing in just two days due to high demand from people in their 30s.

As of May 31, CU had sold 95% of its 770 gold items, buoyed by prices falling below market rates, according to a statement from BGF Retail Co. The chain plans to introduce gold bars ranging from 2 to 10 grams, although no specific date has been given.

Additionally, Kbank, an online bank with over 10 million users, began a service on May 9 allowing the purchase of gold bars from 1.875 grams to 37.5 grams with free delivery, as online banks also respond to rising gold demand.

“With the price of gold recently topping $2,400 per ounce, investing in gold has become a popular way,” Kbank said in a statement.

About Costco, late last year, we wrote: "It's an incredible commentary on the average American citizen. Americans are literally choosing to transact U.S. dollars for gold."

The U.S. Economy Is "Finally Cracking"

The U.S. economy seems to finally be cracking. This month a slew of retailers (off the top of my head: Target, Lowe’s, Macy’s, Kohl’s, Best Buy and Foot Locker) reported negative year-over-year sales comps, and that’s before adjusting for the inflation that makes them 3% to 4% more negative in “real” terms.

Others (Dollar General and Burlington) reported same-store sales comps in the +2% range, but that too was negative when adjusted for inflation, while Walmart and Nordstrom comps managed to roughly keep pace with inflation, but were unable to exceed it. (To its credit, Costco comps did handily beat inflation—I wish I’d bought that damn stock 15 years ago!)

Corroborating the poor retail sales data, final Q1 GDP growth (released May 30th) came in at just 1.3%, primarily because of the weakening consumer, while pending home sales plunged.

At some imminent point in time, this stock market will switch from "bad news is good news" to "bad news is bad news" as it suddenly realizes that there's a HARD economic landing coming and sticky inflation (3.6% core CPI and 2.8% core PCE ) driven by massive federal budget deficits prevents the Fed from cutting enough to compensate for it. That's what we remain positioned for.

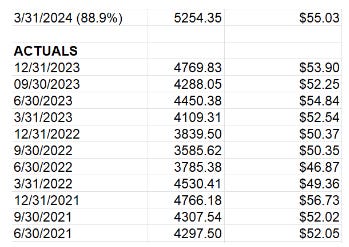

In the far-right column below from Standard & Poor’s are the 12 most recent quarterly operating earnings for the S&P 500 (with Q1 2024 estimated with 88.9% of companies having reported) and, in the middle column, the price of the S&P 500 as of that date. (The S&P 500 is now at 5277.)

As you can see, nominal earnings have barely grown in the last three years, and although Q1 2024 earnings were up 4.7% year-over-year, that’s only around 1.2% CPI-adjusted. Additionally, those latest earnings are lower “nominally” and much lower “inflation-adjusted” than they were way back in Q4 2021 (when stock prices were much lower). In fact, adjusting for inflation,

Q1 2024 earnings came in lower than every quarter of 2021! Annualizing those Q1 2024 earnings to $220.12 ($55.03 x 4) and putting a long-term market average 16x multiple on them would bring the S&P 500 all the way down to just 3522 vs. May’s close of 5277. Even an 18x multiple would bring the S&P down to just 3962 vs. the current 5277. And then what happens to those earnings when we get a recession? CONTINUE

OMG.. Shawn Ryan BREAKS DOWN Issues A CHILLING Scary W*rning - Prepare Your Family

www.youtube.com/TheMacs 1Timothy5:8