The U.S. economy seems to finally be cracking. This month a slew of retailers (off the top of my head: Target, Lowe’s, Macy’s, Kohl’s, Best Buy and Foot Locker) reported negative year-over-year sales comps, and that’s before adjusting for the inflation that makes them 3% to 4% more negative in “real” terms.

Others (Dollar General and Burlington) reported same-store sales comps in the +2% range, but that too was negative when adjusted for inflation, while Walmart and Nordstrom comps managed to roughly keep pace with inflation, but were unable to exceed it. (To its credit, Costco comps did handily beat inflation—I wish I’d bought that damn stock 15 years ago!)

Corroborating the poor retail sales data, final Q1 GDP growth (released May 30th) came in at just 1.3%, primarily because of the weakening consumer, while pending home sales plunged.

At some imminent point in time, this stock market will switch from "bad news is good news" to "bad news is bad news" as it suddenly realizes that there's a HARD economic landing coming and sticky inflation (3.6% core CPI and 2.8% core PCE ) driven by massive federal budget deficits prevents the Fed from cutting enough to compensate for it. That's what we remain positioned for.

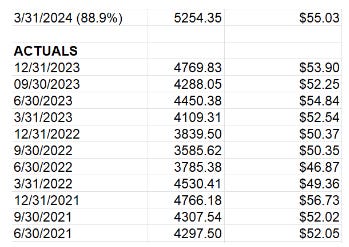

In the far-right column below from Standard & Poor’s are the 12 most recent quarterly operating earnings for the S&P 500 (with Q1 2024 estimated with 88.9% of companies having reported) and, in the middle column, the price of the S&P 500 as of that date. (The S&P 500 is now at 5277.)

As you can see, nominal earnings have barely grown in the last three years, and although Q1 2024 earnings were up 4.7% year-over-year, that’s only around 1.2% CPI-adjusted. Additionally, those latest earnings are lower “nominally” and much lower “inflation-adjusted” than they were way back in Q4 2021 (when stock prices were much lower). In fact, adjusting for inflation,

Q1 2024 earnings came in lower than every quarter of 2021! Annualizing those Q1 2024 earnings to $220.12 ($55.03 x 4) and putting a long-term market average 16x multiple on them would bring the S&P 500 all the way down to just 3522 vs. May’s close of 5277. Even an 18x multiple would bring the S&P down to just 3962 vs. the current 5277. And then what happens to those earnings when we get a recession? CONTINUE

No comments:

Post a Comment

THANK YOU